If you want to register a new business in the state of Indiana, then the first and foremost step is to name it. This can be done by performing a business entity search. So, How can you do the Indiana business entity search? Keep reading and we will clear all your doubts about how you can complete the business search for Indiana and what are the possible steps available after finalizing a name for your business.

Why choose Indiana to set up a new business? With its focus on tech and innovation, Indiana offers a strong economic climate to new businesses. The business operation and setup cost in Indiana is also comparatively lower. With a state income tax of just 3.23 %, Indiana’s tax structure also proves to be very business-friendly. For small to medium startups, we would suggest forming a limited liability company in Indiana. An LLC grants all the benefits that a corporation provides but with the security of your personal wealth.

Indiana Business Entity Search

The first prime step before starting a business in Indiana is the Indiana Business entity search. But before we define business entity search, let’s first find out what a business entity actually is. Business entities, in simplest terms, are legal bodies through which a business is conducted. This can be formed by an individual or a group of individuals. Likewise, a business entity search is basically a process carried out in order to find an appropriate and preferable unique business name. Your entity or business name cannot exactly match any registered entity name. However, if it matches someone else’s business name, your entity name will be rejected by the Indiana secretary of state. Hence, a business entity search is important which shall be carried out on the official portal of the Indiana secretary of state business search.

Indiana LLC Naming Guidelines

Before you complete the business name search, make sure your entity name meets the LLC guidelines. The Indiana LLC naming guidelines are as follows:

- The entity name must include “LLC”, “L.L.C.”, or “limited liability company”.

- In addition, some extra paperwork might be required if you use words like University, Bank, or Attorney.

- Words like Treasury, FBI, State Department, etc can’t be used. These are the words that can confuse your LLC with any government agency. Hence, avoid using such words.

Indiana Business Entity Search Method

Different states in the United States have different procedures to perform the entity search. So, what is the procedure for the Indiana business entity search? For that, you need to carry out a search on the official portal of the Indiana Secretary of State business search:

1. Search By Business Name

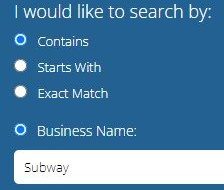

Once you open the Indiana SOS business search page, you can directly perform the entity name search by typing your desired business name in the business name search bar.

- After that, press the search button and you will be redirected to the search result page.

- The names that are exact or similar to your searched name will be listed with all the important information. This includes business ID, entity type, business name, office address, agent name, and status.

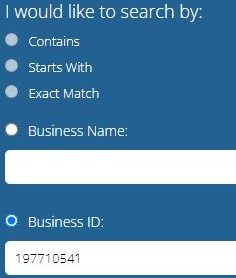

2. Search By Business ID

Similarly, you can carry out a search using a business ID as well. Enter the business id of a business and perform a search.

After that, hit the search button and you can carry on with your Indiana business entity search.

3. Search By Filing Number

Likewise, you can also conduct an inquiry of a registered business in Indiana by providing a valid Filing number of a business.

Reserving Your Indiana LLC Name

Indiana business entity search tells you whether your LLC name is available or not. You can reserve any name for up to 120 days. This allows you to continue searching for a better name. The state of Indiana allows Name Reservation if you are not ready to start your business but don’t want to lose the unique name. You can reserve a name for up to 120 days. In addition, a $20 processing fee is charged to reserve your Indiana LLC.

Registering Your Indiana LLC Name

Once you have selected your available and preferable business name through the Indiana business entity search, you will need to follow the necessary process in order to register your LLC name in Indiana. Firstly, you are required to select a registered agent for your Indiana LLC. The registered agent should be a resident of Indiana. Once you have selected your preferable Indiana agent, you need to file the Articles of Organization with the SOS business service division. You can register your Indiana LLC online as well. The cost of an LLC name in Indiana is about $95. Once you complete this procedure, it’ll take 1 day for online filing and 5-7 business days by mail to get your Indiana LLC.

Revising Your Indiana LLC Name

There can be times when you might feel like changing or revising your Indiana LLC name. Similarly, there could be a number of reasons for that which might include a spelling error, business growth, or rebranding your business. You can simply revise your Indiana LLC name by accessing the official portal of the Indiana SOS business search.

Domain & Trademark

Selecting a suitable domain name is also very important for the success of your online business. Your domain should match your business name and if not, it should have some similarities. You can secure your registered company with a trademark. Trademark provides security to businesses and consumers. To run a successful company trademarks play a major role. In the State of Indiana, you can choose to request a trademark for your company. This normally costs between $225 to $400.

Frequently Asked Questions

You can carry out a business entity search on the official portal of the Indiana Secretary of State.

Yes, you or any individual in your company can also become a registered agent for your LLC.

The cost to form an LLC in the state of Indiana is $100 by mail and $95 for online registration.

It is preferable to form an LLC. However, It is not necessary to have an LLC to start a business.

Yes, you can search for all the basic information regarding entities on the official portal of the SOS business search for free. However, there are some that are not free. 1. How can I check if my preferable name is available in Indiana?

2. Can I be my own Registered Agent?

3. What is the cost of an Indiana LLC?

4. Should I apply for LLC registration before starting a business?

5. Is it free to search for basic information about other entities in the state of Indiana?