When we open a business, we often overlook the small minute details that help our business stand apart from its competitors. One such crucial factor in building business credit. Building a good business credit helps us in innumerable ways. From getting finance to having insurance and setting terms with suppliers. All these become smooth when we have good business credit. So before we try to build our business credit, let us know in detail what is business credit and what its benefits are.

What is Business Credit?

We all have heard about Business credit at some point in time, but do we really know what it is? Many businessmen consider it to be a financial tool, that helps us to qualify in getting loans and raising finances. Earning business credit is a process where businessmen establish a relationship with their vendors and sellers. It is an immediate relationship that is followed by trustworthiness and builds a name for the business.

How Good Business Credit Can Benefit You?

For new potential investors, business credit is a tool that helps them understand how healthy your business is in terms of finances. Having a good business credit helps us in the following ways-

- Getting Financing Easily – Once you have a good business credit your business reputation in the market also grows exponentially and financing becomes cheaper.

- No Prepayment – Once your vendors gain your trust and see that you have stable business credit, you don’t need to pay them early to get your items delivered. they will give you time for paying them even after delivery is done.

- Better Terms with Suppliers – Your credit score helps you get on good terms and negotiate better deals with suppliers and vendors.

- Separation of Personal Finances – Often small business owners invest their own assets in the business which can turn out to be fatal in the long run. Having a good business score means you don’t have to invest your own money instead financers would be there to help you out.

- A Financially Stable Business – Once you have a business credit you don’t have to further worry about the finances. You can then take risks of expanding your business in the long run.

How to Build Business Credit?

Now that you know what is business credit you must be wondering how you can build one. In this section, we will be explaining the various ways how you can build strong business credit.

1. Choose to Build The Right Business Foundation

The first step towards building credit is to build a distinct legal business entity. You can form an LLP, corporation or LLC depending upon your business goals and structure. Once you have decided on the right business model for you, you need to get it registered. The registration process would depend on the structure and business location you have chosen. The registration process may take some time. Once you have submitted your application, you need to wait for the approval. During this time you should get a business phone number and get it registered in the directory assistance. Additionally, you should also have an email and mailing address where your clients can contact you effectively. All this done together would make your business look more professional and legit.

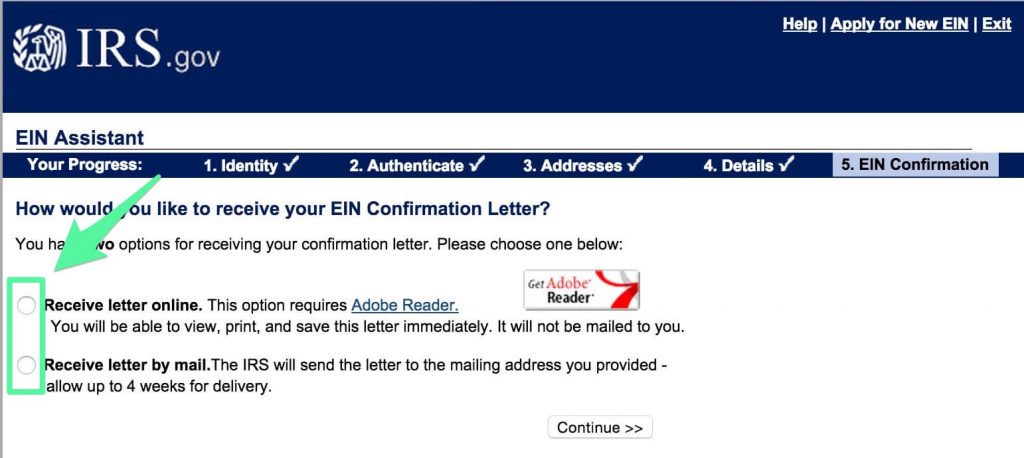

2. Get Your EIN Number

Once your business is registered the next step is to get your Employer Identification Number or EIN. This number is just like a social security number for businesses. This is your next important step towards building business credit. The EIN number is also often called the Federal Tax Id number and it consists of 9 digits. This EIN number helps you in opening a business bank account, applying for a business credit card, for taxes and permits including the company tax returns.

3. Open a Business Bank Account and Report to Business Credit Agencies

Once you have got your business registered and the EIN number now you can open a business bank account for all your business transactions. Once you separate your business and personal transactions, the liability gets reduced. Having a business bank account and a good banking relationship has an important role to play when you apply for funding. There are several business credit agencies like Equifax, Dun and Bradstreet, and Experian. And All these have different formulas through which they can calculate the business credit score. You will not know which vendor or supplier would check which credit score so it’s best if you can maintain all these 3 credit agencies.

4. Establish Vendor Trade Lines

To use these business credit agencies it is equally important that you talk with your supplier and vendor. When you purchase any material from suppliers your credit and payment details gets reported to the credit agencies. You will have to agree with your supplier regarding the payment terms. Many suppliers extend trade credits so that you get ample time to pay them after you have received your order.

5. Make Payments on Time

Your past and present history of paying matters in your business credit scores.If you pay on time and has not been late fined then your crest score would be good. As we said earlier the calculation of credit scores may vary from agency to agency but the records of payment are always a crucial factor. Remember to choose your supplier wisely. It is recommended that you choose Vendors who report to these business credit report agencies. In future, these references can be counted as future reference applications. Paying on time helps you easily get a bank loan without any hurdles.

6. Monitor Your Credit Reports

There are a few business credit agencies, and you must always pay attention to their credit reports. If you find any mistakes you must immediately bring them to their notice. If your credit report is updated and correct then there are high chances for you to get the best interest rates and repayment benefits in your bank loans.

7. Apply for a Business Credit Card

A business credit card comes with lots of benefits. If you pay it on time every month you can enjoy a 0% APR. Many business credit cards also come with reward points which you can redeem to get exciting cash benefits as well. These credit card statements have a great impact to build your business credit.

8. Keep Your Records Clean

Apart from your credit reports and statement, another thing that plays a vital role in building your business credit is keeping your records clean. Your business credit report would have all details filed in your business’s name. From any liens to bankruptcy, judgements and collections have a long term effect on the business credit.

How To Maintain Your Business Credit

Once you have to build a good business credit score, the next important step is to maintain the credit score. You may not need to continually build it but holding on to the score is also equally important. And, the easiest way to do that is to pay your bills on time and maintain good relationships with all your vendors and suppliers. At times you must also check your credit score and many third-party agencies can help you in checking and evaluating your business credit.

In Conclusion

We hope you have now understood the detailed process on how to build business build credit. It is advised that you follow the process step by step and take time in building trust among your clients and suppliers. Words of Mouth also helps businesses gain good business credit in the market.